INSIGHTS ON INCOME TAX BENEFITS OF NPS AND EPF : NEW TAX REGIME

- Wed Mar 05 18:30:00 UTC 2025

- In Mentoring and Guidance by Aparna Bose

We have previously published detailed articles on the National Pension System (NPS) and the Employees' Provident Fund (EPF), which are available under the "Mentoring and Guidance" category on this platform. This write-up will focus on the key features that distinguish these two systems, particularly in relation to the new tax regime.

Under the new tax regime, only selective exemptions and deductions can be claimed. Before we delve into the specifics, let’s revisit some essential points .

1. For Subscribers Joining NPS Before Age 60:

Lock-in Period: 5 years, or until the subscriber reaches 60 years of age, whichever comes first.

Normal Exit: Subscribers can exit at the age of superannuation (60 years). They also have the option to continue or defer their investment until the age of 75.

2. For Subscribers Joining NPS After Age 60:

Lock-in Period: 3 years.

Subscribers can continue or defer their investment until the age of 75.

Withdrawal Options

Exit Before Superannuation:

Subscribers are allowed to withdraw up to 20% of their accumulated pension corpus as a lump sum.

The remaining 80% must be mandatorily allocated toward the purchase of an annuity.

If the accumulated pension corpus is ₹2.5 lakh or less, the subscriber may withdraw the entire amount as a lump sum.

Exit at Superannuation/Maturity:

- Subscribers can withdraw up to 60% of their accumulated pension corpus as a lump sum or withdraw it in phases through the Systematic Lump Sum Withdrawal (SLW) facility. This can be done periodically—monthly, quarterly, half-yearly, or annually—up until the age of 75, according to their preferences during normal exit.

- The remaining 40% of the accumulated pension corpus must be mandatorily utilized to purchase an annuity.

- If the accumulated pension corpus amounts to ₹5 lakh or less, the entire sum can be withdrawn as a lump sum.

Exit Due to Death:

- In the event of the subscriber's death during the investment tenure, the nominee(s) or legal heir(s) are entitled to withdraw the entire accumulated corpus.

- For government subscribers, 80% of the accumulated pension corpus must be directed towards a default annuity plan for dependents (spouse, mother, or father, in that order), with the remaining balance going to the nominees. If there are no dependents, the full amount is returned to the nominee(s) or legal heir(s). If the accumulated corpus is ₹5 lakh or less, the entire amount is disbursed to the nominee(s) or legal heir(s).

Tax benefit on Annuity purchase

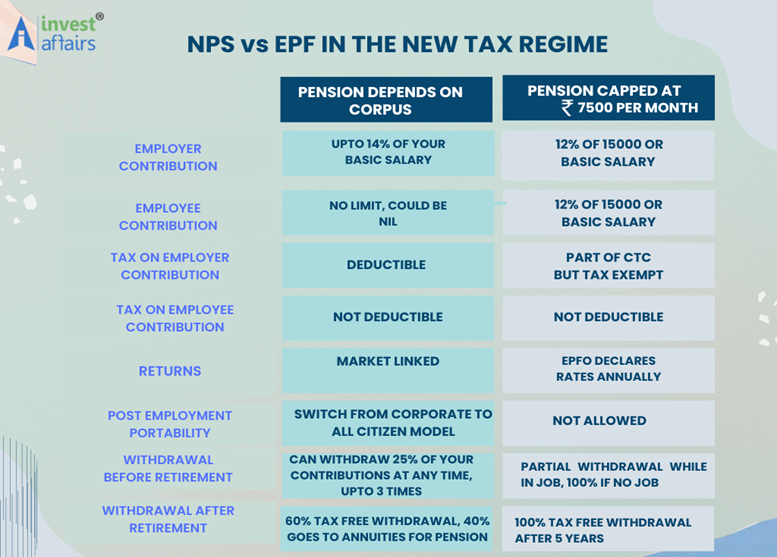

Under the new tax regime, deductions for the Employees' Provident Fund (EPF) are not available, while the National Pension System (NPS) still offers tax-saving opportunities. Although the EPF provides stability, the NPS can provide more significant tax benefits under the current regulations. Additionally, contributions made by employers towards the NPS can help lower your taxable income under the new tax regime.

When considering retirement savings options in light of the new tax regime, the NPS may offer more advantageous tax benefits compared to the EPF. A detailed comparison of these options is presented in the table below:

FAQ

What is Sec 80CCD?

- 80CCD(1): Contributions made by the employee/self (salaried or self-employed) to NPS.

- 80CCD(2): Contributions made by the employer towards NPS.

How to claim 80CCD(2) in new tax regime?

Under Section 80CCD(2), deduction is available on employer's contribution to NPS. An employer can make contributions towards NPS in addition to those made towards PPF and EPF. The contribution made by the employer can be equal to or higher than the employee's contribution.

What are the terms and Conditions for Deductions under Section 80CCD?

- Deductions under Section 80CCD are available to salaried as well as self-employed individuals. While it is mandatory for government employees, for other individuals, it is voluntary.

- The maximum deduction limit available under Section 80CCD is Rs 2 lakhs; this includes the additional deduction of Rs 50,000 available under 80CCD(1B).

- Tax benefits availed under Section 80CCD cannot be claimed again under Section 80C, i.e. the combined deduction under Section 80C and 80CCD cannot exceed Rs 2 lakhs.

- The money received from NPS as monthly payments or surrendered accounts will be liable for taxation as per the applicable provisions.

- Any amount received from NPS reinvested in the annuity plan is entirely exempt from taxation. The deductions available under Section 80CCD can be claimed at the end of the financial year when you file your income tax returns. You will be required to produce proof of payment to be eligible for this deduction.

What is the difference between 80CCD(1) and 80CCD(2)?

80CCD(1) is deduction based on the contributions made by employee/self to NPS and 80CCD(2) is for the contributions made by employer towards NPS.

Which tax regime is more beneficial, old or new?

Considering the value of tax benefits and post-retirement benefits the old Tax Regime would be more beneficial in respect of investment made in NPS if the contribution made is substantially large since you can claim a deduction up to Rs. 2,00,000 for self-contribution and contribution made by the employer as well. Whereas in the New Tax Regime, the deduction is restricted to contribution made by the employer only.

If I am opting for the New Tax Regime during the AY 2024-25, what is the maximum limit of deduction available for contribution towards NPS?

Contribution towards NPS by the taxpayer himself allows deduction from the Gross Total Income of an individual in three different sections of the Income-tax Act,1961 viz., Sec 80CCD(1), 80CCD(1B) and will be available only under the old tax regime.

Whereas if the new tax regime is selected, then deduction for the employer’s contribution towards the employee’s NPS a/c is available. The deduction would be restricted to 14% of the salary, in case of a contribution made by the Central Government or State Government and to 10% of the salary in case of any other employer.

Can we claim both 80CCD 1B and 80CCD 1?

Section 80CCD(1) allows a deduction of up to ₹ 1,50,000 for self-contributions to NPS or APY. Section 80CCD(1B) allows an additional deduction of up to ₹ 50,000 over and above the limit of Section 80CCD(1). However, it should be noted that the same contribution cannot be claimed as deduction under both these sections.

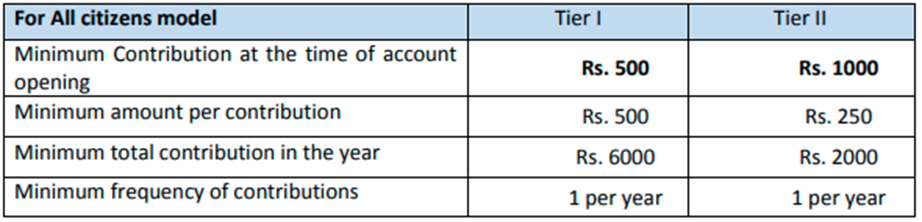

What is the minimum contribution for NPS?

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts